Sub-Saharan Africa has yet to undergo a full industrial or agricultural revolution. One of the main underlying reasons is a lack of energy. Energy is a precursor to both economic and social development. It is needed to fight poverty, power both brick-and-mortar and digital businesses, provide a modern education, ensure health and safety, provide clean water and sanitation, build roads, create jobs, produce and deliver food, and last but not least (if produced cleanly) to fight climate change.

Universal electrification, therefore, is the key to unlocking the continent’s vast potential. It is now widely accepted by development banks, national governments and multilateral agencies that providing modern electricity to hundreds of millions of rural Africans can only happen by scaling solar minigrids — small, localized power generation plants that deliver electricity to surrounding communities via transmission and distribution networks.

However, despite this growing consensus, scale remains elusive in Africa’s minigrid industry.

By the start of 2023, there was only one profitable minigrid developer: Husk Power, where I serve as chairman and chief strategy officer. As a result of this lack of widespread profitability, many investors have stayed on the sidelines. If that trend continues, universal electrification will not happen in Africa. What is needed is a clearly defined pathway for minigrid companies to develop sustainable business models and scale. Other industries have benefited from such roadmaps, which set forth a path to profitability and scale with clear and specific metrics — and timelines for achieving those metrics.

A Roadmap for the Rural Minigrid Industry

Based on our experience as pioneers in the rural minigrid industry since 2008, my fellow Husk executives and I decided to share our learnings, producing a roadmap for the industry in late 2022.

The roadmap lays out the main characteristics for viability and scale in the minigrid industry, and identifies the appropriate key performance indicators (KPIs) and timelines to achieve them. These KPIs incorporate the innovation needed in both technology and business models. Such innovation is possible, but only if R&D, private capital and concessional funding are directed at the right solutions. The roadmap is an attempt to shift the focus toward those solutions, not only for minigrid developers but for the entire ecosystem of donors, investors, suppliers and regulators.

So where should our focus be?

The biggest hurdle for minigrids has been the lack of a working business model. Without one, profitable companies will not emerge and investment will remain scarce. Barriers are largely two-fold: The costs incurred by minigrid developers are too high, and customer demand is too low. As a result, the electricity generated by most minigrids is not even being fully used much of the time (a challenge known as low capacity utilization).

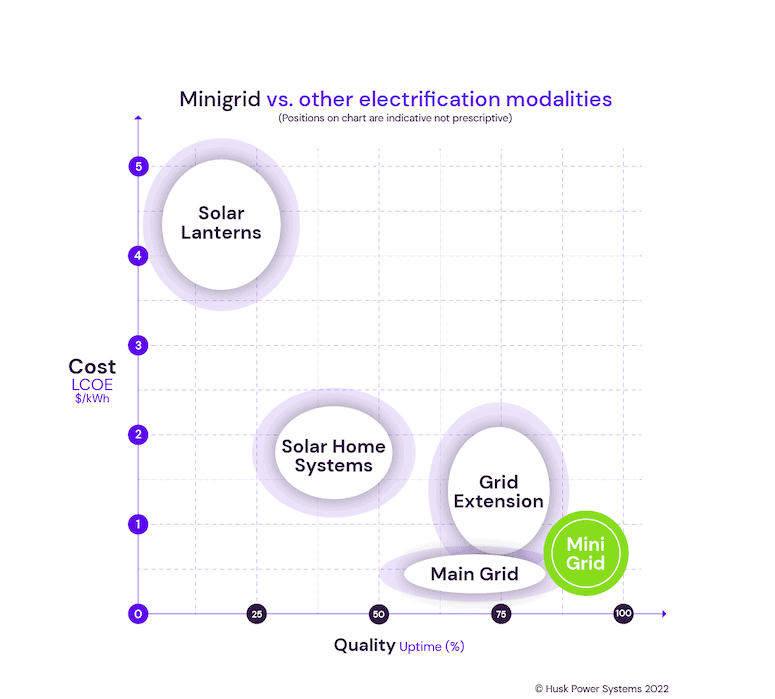

Addressing these challenges is step one, and I’ll discuss some possible solutions below. But once the business model is working, there is still the non-trivial challenge of scale. Based on the current rate of minigrid deployment, the industry needs to achieve a pace that is 10 times the industry-leading deployment rate at Husk Power, which is able to roll out 16 minigrids per month on a sustained basis. At current rates, we estimate that it would take more than 100 years to reach the 100,000 – 200,000 minigrids needed to achieve universal electrification in Africa — yet Sustainable Development Goal (SDG) 7 calls for this to happen by 2030. Even after factoring in other solutions like grid expansion and solar home systems, it’s clear that the minigrid sector must scale dramatically if we hope to make global energy access a reality in the coming years.

The Challenges Facing Africa’s Minigrid Industry

According to the roadmap, cost, quality, demand and some level of local scale are needed to achieve a reasonable return for investors. Only when profitability is achieved is scaling possible. As obvious as that may seem, many developers have attempted to replicate unprofitable business models — with predictable results.

Fixing this is not simple, and it requires a new approach that is fundamentally different and more impactful than the traditional utility model — which has only consisted of selling electricity and collecting payment. In rural communities that have no history of reliable electricity, this status quo approach is not workable. For one reason, the vast majority of households and businesses in these communities have never bought machinery and appliances that use electricity. With no power to run them, why would they? Therefore, minigrid companies must be “utilities ++” in the off-grid and weak grid areas where they operate, by focusing as much or more on demand than on supply. This often requires demand-stimulation activities in the community (like partnering with farmer collectives) and marketing and sales efforts that energy suppliers often lack.

Compounding this challenge is the fact that rural communities in Africa rarely if ever have as much wealth as urban areas. Full-time or part-time work is scarce, and the consumer’s ability to pay is weak. So minigrid companies need to provide a low-cost service to match the needs of the consumer, even though they do not yet have the economies of scale or the subsidies enjoyed by the centralized grid.

Unfortunately, they cannot address the affordability issue by compromising quality. To kickstart the rural economy, users need consistent power — and they often need lots of it. For farmers to join the 21st century economy and replace rain-fed irrigation and hand grinding with pumps and mills, their power requirements go up 10 to 100-fold. For clinics and hospitals to store vaccines and operate on patients, they need reliable power 24/7. Providing high-quality power at low cost is not easy at the current scale of minigrids, but it is necessary to make the business model work.

And then there is still the problem of scale. Billions of dollars are needed to achieve universal electrification in Africa. To attract such investment, minigrid developers must show the return on investment that investors expect. Therefore, scale is also directly linked to profitability.

Light at the end of the tunnel

These challenges may be vexing, but they can drive incredible innovation — not just in technology, but in business models, organizational capacity, sales and marketing, and modes of finance. Companies that invest in all of these areas can succeed, and are succeeding. The fact that Husk Power achieved profitability in both Asia and Africa in the last quarter of 2022 is evidence of that.

Africa’s energy industry found success in the last decade in providing basic levels of electricity from small solar home systems (for lighting and phone charging). But in the remaining years before the SDGs’ target date of 2030, the industry must shift to providing higher levels of energy that can kickstart rural economies. Centralized power utilities have failed for decades to fulfil this role, and they continue to be mired in under-resourced management and heavy debt, with only two of 39 countries surveyed in sub-Saharan Africa having profitable utilities as of 2016. Meanwhile diesel generators — which have filled the gap left by grid failures and produce more power than the grid in 17 countries in the region — are also no longer an affordable option, either economically or environmentally.

As we look toward the coming months, 2023 can finally be the year that minigrids emerge as the solution for universal energy access, and more importantly for powering rural growth, in Africa. The roadmap is there, and the destination is clear. Now is the time for the industry to follow it.

Brad Mattson is chairman of Husk Power Systems, and board member of the Africa Minigrid Developers Association (AMDA).

Photo: A Husk Power minigrid. Photo courtesy of Husk Power Systems.